How to Check & Monitor Your Credit for Free in Canada

In this guide, you'll learn how to monitor your credit score every month for free without damaging your credit, and how to understand and interpret what's on your credit report.

So how do you get a monthly free credit report in canada?

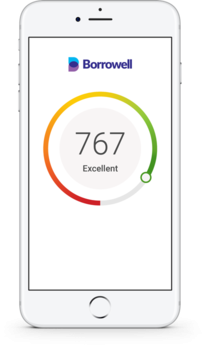

Checking your credit score is easier than you think. You can now check our credit score for free, from companies like Borrowell. Borrowell’s free credit score service will also send you monthly updates, so you can track your score and look out for any changes.

With Borrowell, all you have to do is fill in a quick online form and provide them with some information about yourself, so they can verify your identity and provide you with your free credit score. Don’t worry — according to Borrowell, your information will be safe with them.

Why should you monitor your credit score?

It doesn’t matter if your credit score is good or bad — you should be aware of what it is. Similar to how you should go to the doctor for regular health checks, it’s a good idea to check your credit score regularly to know where you stand.

Since your credit score is like your financial report card, you should know how you’re doing so you can take action to improve your credit score if it’s not doing so good.

Make sure you improve or maintain your credit score

If your credit score is pretty good now, it’s not time to sit back and gloat! Make sure you know how to maintain your good credit — by doing things like keeping your utilization ratio down, paying your bills on time, and consolidating your debt if you have any.

Your utilization ratio refers to how much available credit you’re using. This is important as your utilization ratio contributes to 30% of your overall credit rating. If your credit card limit is $5000 and your credit card balance is $2500, your utilization ratio is 50%. This may not be the worst, but not the best utilization ratio either. In the eyes of your credit bureau, you should aim for a utilization ratio of under 70%.

Look out for unsuspected changes in your score

Minor fluctuations in your credit score are usually a reflection of your spending habits, but sometimes, it could be a sign of something more sinister. If your credit score drops suddenly, ask yourself if there could be a legitimate reason why this could be happening.

Perhaps you’ve just opened a new line of credit or applied for a new mortgage. Your potential lenders would have pulled a hard credit check on your bureau, which may result in a small ding on your credit score if you applied at multiple institutions. Soft credit checks do not affect your credit score—so things like checking your credit score should not hurt your score.

Unexpected changes in your credit score could be an early sign of identity fraud. Large scale security breaches are becoming increasingly common. The threat of identity fraud is much closer than you think.

What do identity thieves do with your personal information? They may open new accounts, take out loans without paying them back or copy your debit and credit cards to take out money from your bank account. By monitoring your credit score regularly, you can take action once you notice an unexpected dip in your score before it is too late.

You’re about to apply for a new loan or line of credit

Imagine dreaming about your ideal house for years and working really hard to purchase it. Now you’ve saved up enough money and are excited for the next big chapter of your life. You’ve got your eye on a house already, and you and your partner have been talking about when to apply for a mortgage for months. You finally apply for one—to your surprise, your credit score is not what you thought it would be. If your score is lower than what you expected, your house purchasing plans may be thrown off, as you don’t qualify for the mortgage you planned for.

Don’t let this be you! Make sure you’re always aware of your score so you can make more informed choices for major financial decisions in your life.

You may qualify for better credit cards

When you improve your credit score, your chances of being approved for credit cards with better interest rates, perks, and rewards improves as well. Depending on your credit card provider, you may be able to use your improved credit score as a bargaining point for lowering your credit card interest fee.

What's the difference between a credit score vs credit report?

What is a Credit Report?

Your credit report contains your financial history, which includes payments, accounts, balances, credit inquiries done by potential lenders, landlords, and employers, and other personal information. If you’ve ever had a bank account or credit card, you have a financial history.

What is a Credit Score?

Your credit score is essentially your adult report card — more specifically, your financial report card. It’s a number that tells your potential creditors like landlords, lenders, and employers how good you are with money. The good news is, like that dreaded report card from your school years, you can improve it by working to improve your financial health.

Your credit score is calculated from your credit report based on complex algorithms using the information on your credit report. In Canada, there are 3 major credit reporting agencies: Equifax, TransUnion, and Experian. The 3 major credit reporting agencies use their own formulas to calculate your credit score, so your credit score may be slightly different with each agency.

Get your free credit score today!

We hope we’ve provided you with some useful information on how to monitor your credit score with companies like Borrowell, and why you should monitor it. Remember, knowing your credit score is important for your own financial well-being! It can also help protect you against fraud and identity theft. Get your free credit score today from Borrowell. Since it's only a soft pull, this won’t affect your credit score!