If you’ve ever had a credit card, applied for a loan, or had anything to do with the world of personal finance, you’ve probably heard of credit scores. Your credit score plays an important role with relation to personal finance and your ability to achieve your financial goals.

Whether you’re new to Canada, new to the concept of credit, trying to find out why you have bad credit, or just brushing up on your personal finance education, you’ve come to the right place!

Let’s explore what a credit score is, why credit scores are important, how credit score numbers are calculated, and how you should manage your credit report going forward.

What is a credit score?

A credit score is a three-digit number that ranges from roughly 300 to 900. The higher the number, the better. In addition, it communicates your creditworthiness to interested parties, such as banks, other lenders, and sometimes even employers. A credit score is calculated using historical personal and financial information. It looks at how you handled credit in the past as this usually predicts how you will handle credit in the future.

In Canada, there are two credit bureaus that determine your credit score: Equifax and TransUnion. Because there are two credit bureaus in Canada, and we each have two slightly different credit scores. The variance between the two credit scores has to do with Equifax and TransUnion’s varying methods of calculating credit scores.

Why is my credit score so important?

A credit score is important in the world of personal finance because it’s used to obtain financing and to help you achieve your financial goals. If you want a loan for a car, house, renovation, or virtually any other purpose, your credit score has a lot to do with whether or not you’ll get approved. It’s pretty common practice for lenders of all types to look at a loan candidate’s credit score and report before extending credit.

Achieving your financial goals is still possible if your credit score isn’t the greatest, but a higher credit score makes the process simpler overall. Higher credit scores can get you lower interest rates, better terms, and quicker and easier approval among other things. For this reason, a higher credit score can help you achieve your financial goals faster and with less hassle.

What is considered a good credit score?

According to Equifax, a good credit score is considered to be between 660 and 724. However, there are many other levels within the 300 to 900 credit score range. Let’s take a look at the ranges below.

- 300 to 559 - Poor

- 560 to 659 - Fair

- 660 to 724 - Good

- 725 to 759 - Very Good

- 760 to 900 - Excellent

Keep in mind that lenders have varying requirements and approval processes before they extend financing. While the above are great reference points, some lenders may have different opinions on what is considered poor credit versus excellent credit when considering applicants. For example, banks are known to be more strict with credit scores than alternative lenders.

How is my credit score calculated?

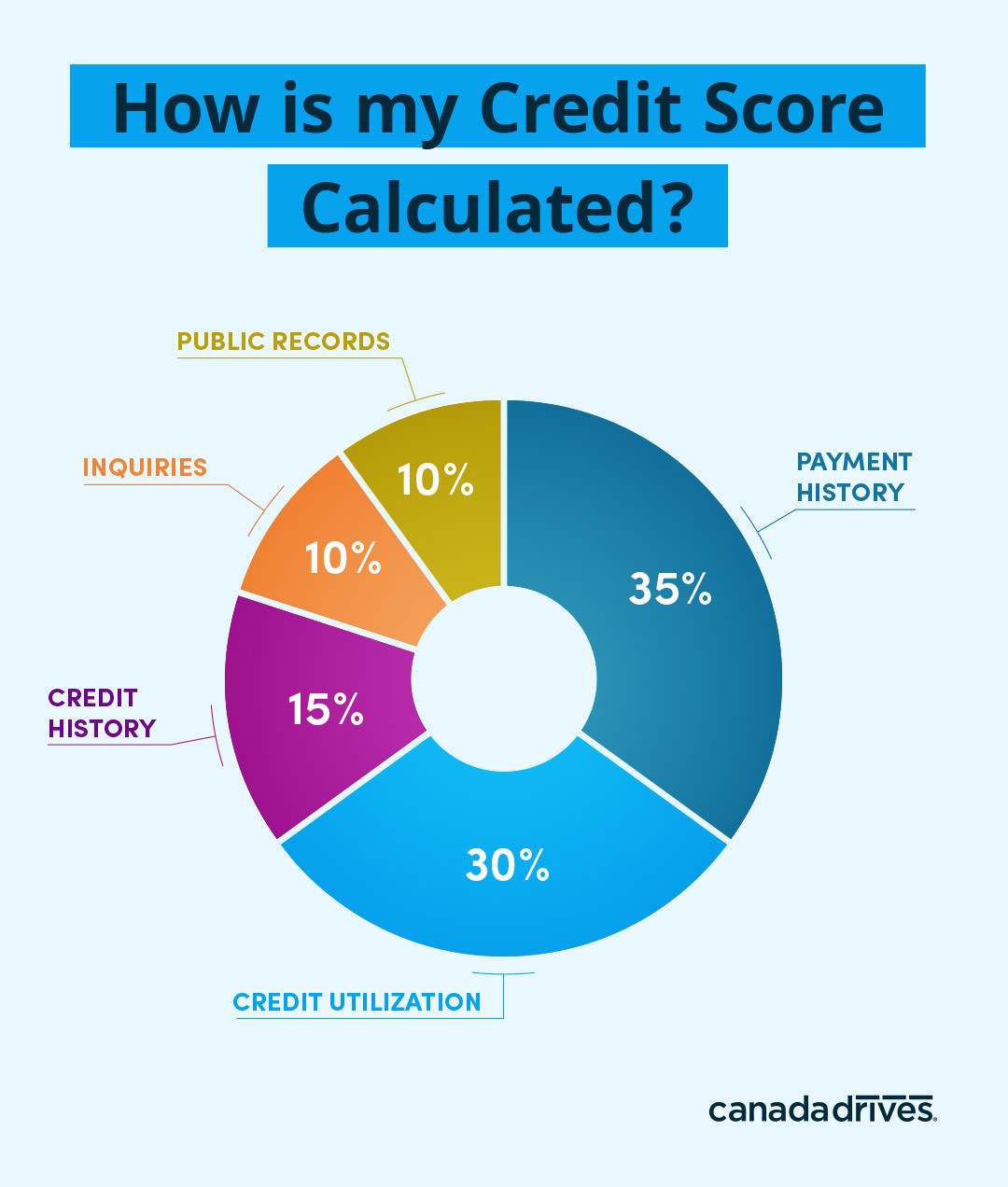

To determine if an applicant will be able to pay back a loan, most lenders will request a credit report from one of the credit bureaus—Equifax and TransUnion. Your credit report contains all aspects of your lending history and includes your credit score. There are many different scoring models, but your credit score is generally calculated using five major criteria:

1. Payment history: 35%

This factor makes up the bulk of your credit score making it the most crucial factor. This factor considers how you’ve handled repayment of any kind of debt or credit in the past. Financial items that might hurt you in this section include late payments, partial payments, accounts in collections, delinquencies, bankruptcies, liens, and missed payments.

Pro Tip: Automate your payments. Always make monthly payments on time and in full. Missing just one payment can damage your credit, while consistently making payments can help your credit. Your history of payments is the biggest factor that can both negatively and positively affect your credit score.

2. Credit utilization & Amounts owed: 30%

Your existing debts are an important consideration. How much debt are you currently shouldering and how easy would it be for you to repay all of your debts right now if you had to? Your credit score is partially calculated based on the answers to these questions.

This criteria considers all of the credit that has been extended to you and how much of that credit you’re currently using. In other words, are you constantly maxing out your limits?

Your credit utilization ratio is something you should get familiar with if you’re not already. It calculates how much of your credit you’re currently using in the form of a percentage. For example, if you have a credit card with a $1,000 limit and you currently have a balance of $500, your credit utilization ratio would be 50% ($500 / $1,000). The higher your credit utilization ratio, the more concerned lenders will be since it suggests that you have trouble saving and living within your means.

Pro Tip: Paying down high-interest debt, or any other outstanding debts, will help you score better on this factor. Try to make more than the minimum monthly payments with credit cards. Also, aiming for a credit utilization ratio of 30% or lower is viewed favourably by lenders because it signals that you are in control of your debt.

3. Length of credit history: 15%

In the eyes of creditors, the longer you have been using credit, the more accurately they can measure your creditworthiness. When you’ve been using credit for a long time responsibly, your credit score will improve. This is why individuals with no or little credit have a lower credit score.

Pro Tip: Don’t close old credit cards or other accounts because they’ll disappear from your credit report and history. If an account is removed from your report, it’ll no longer be included in your credit history, which will negatively impact your credit score.

4. Inquiries / new credit: 10%

Anytime you apply for new credit, lenders will pull your credit report which is known as a “hard inquiry”. Hard inquiries are reflected poorly on your credit report because it can indicate financial hardship. This is particularly true if you have a high number of hard inquiries in a short period of time. By contrast, there’s also a term called a “soft inquiry”, this occurs when you pull your own credit report. Thankfully, soft inquiries have no impact to your credit score whatsoever.

Pro Tip: Be mindful of all the credit applications you submit. Checking minimum requirements before you apply is a good idea. By doing so, you can ensure that you don’t submit a credit application that will automatically get declined thereby needlessly hurting your credit score.

Also, please be aware that credit bureaus do usually permit a window of time for rate shopping. For example, if you’re applying for a car loan with different lenders, multiple inquiries will only count for one inquiry during that window of time.

5. Public records: 10%

If you have a prior history of bankruptcy, collections, or other issues, it could have a negative impact on your credit score. Bankruptcy, for example, can stay on your credit report for up to six years.

Pro Tip: Make sure to regularly manage your credit report and check it for any errors. Administrative mistakes happen, and any misreported information about bankruptcy, consumer proposal, or other issues will negatively impact your chances of getting a loan in the future.

How to manage your credit score and report

As we’ve learned, credit scores and reports are important determinants for personal finance and the ability to obtain financing. If you’re planning to apply for finance, it’s wise to become familiar with your credit report and all the behaviours that will boost your credit score.

You should also get into the habit of periodically reviewing your credit report for inaccuracies and errors. To check your credit score and report continuously throughout the year, you can use sites like Borrowell for free. If there are inaccuracies or errors on your report, you can contact the credit bureau to have it changed.

As you probably noticed, the five criteria used to determine your credit score have a lot to do with spending and financial habits. If your credit score isn’t the best, a good place to start is educating yourself on basic personal finance concepts and simple budgeting rules. There are fast ways to raise your credit score, but remember, the key to keeping an excellent credit score is to be consistent in your behaviour with good financial habits.